•

John Mauldin – Buy emerging markets, sell sovereign debt…but not now. Treasuries are going to go lower in the short term

•

Andrew Lowenthal – John is 100% right: Rolling over US debt is going to be so much easier than what people think…it’s too early to short Treasuries

•

Eric Kraus – Buy resource producers in places where people are afraid to invest. Short finance sectors of developed countries

•

Barry Ritholtz – Short the euro, long stocks in 2016, when the next bull market begins

•

Byron King – Sell the euro: It’s doomed, just a question of time. Buy crude oil. There’s just not enough of it. I’m long the Tea Party, too

•

Doug Casey – I’m inclined to own a lot of gold, cattle and agricultural land…keep it simple. I would short the euro, yen and US stock market

•

Gary Gibson – I own nothing. If I had anything, I would have dollars now, uranium later. Buy energy.

•

Eric Fry – Short euro, long uranium

•

Porter Stansberry – There are just too many good shorts. Short Treasuries, especially in US and Italy. Buy gold, silver, timber and super-high-quality blue chips when they yield 10% or more

•

Chris Mayer – Short the state of California and Illinois. Long uranium and high-quality farmland.

•

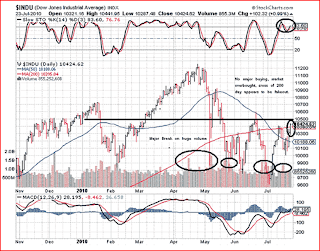

traderpick.blogspot.com - Long USD, Long uranium later, Short AUD and Short Gold when Dow go below 9100.

FIND OUT MORE