Follow me to learn more about investment on market direction. Financial Astrology, Investment Education, technical analysis, The Economy, Stock Trading and more! American investor who said "Astrology is not for millionaires, but for billionaires".

Sunday, October 30, 2011

Tuesday, October 25, 2011

Thursday, October 20, 2011

Wednesday, October 19, 2011

Ironic "Scariest Chart Ever" Redux - America Will Surpass 100% Debt To GDP On Halloween

Yes, ladies and gentlemen: All Hallows E'en will be doubly scary this year: for the first time since World War II, US debt will officially surpass GDP on Halloween 2011.

FIND OUT MORE

Tuesday, October 18, 2011

Monday, October 17, 2011

Sunday, October 16, 2011

Thursday, October 13, 2011

Tuesday, October 11, 2011

Monday, October 10, 2011

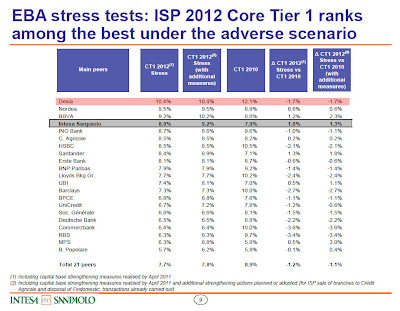

Once Again, Because It Will Never Get Old, Here Are The Safest European Banks According To The Second Euro Stress Test

Here are the safest Europan banks according to the second Euro stress test completed just 3 short months ago. But this time really is different...

FIND OUT MORE

FIND OUT MORE

Sunday, October 9, 2011

Friday, October 7, 2011

Wednesday, October 5, 2011

Positive strength against Negative strength Stock

If the (blue line) number of Positive Strength stocks is greater than the number of Negative Strength stocks (red line), then the Bulls would have the dominant power and the market bias would be to the upside. Since we are measuring 500 stocks, above the 250 level would be the half-way Equilibrium point for which you would also want to see the number of Positive stocks to be above that level. (The higher the amount over that level, the stronger the Bulls are.)

If on the other hand, the number of Negative Strength stocks is above 250 and greater than the number of Positive Strength stocks, then the Bears would have the dominant power and the market bias would be to the downside.

Think about it ... how could the market move up higher if the number Negative Strength stocks were outnumbering the number of Positive Strength stocks? ... and how could the market move up if the Negative Strength stocks were also increasing in numbers as time went on?

FIND OUT MORE

Yield Spread Confirming Recession Call

It is now becoming clearer, even to the mainstream media, that the "Big 'R'" is rapidly approaching, or already upon us. Without further stimulus from the government the economy will continue its slide into negative growth. Unfortunately, it doesn't look like the "Calvary" will be charging to the rescue anytime soon. Bernanke, at this point has effectively punted to the Whitehouse for stimulative action. The Whitehouse is embroiled in partisan politics which will keep any action from occurring until most likely after the next election. This leaves the economy and the financial markets to their own devices, and much like kids without parental supervision, they are running amok.

FIND OUT MORE

Tuesday, October 4, 2011

Monday, October 3, 2011

Subscribe to:

Comments (Atom)